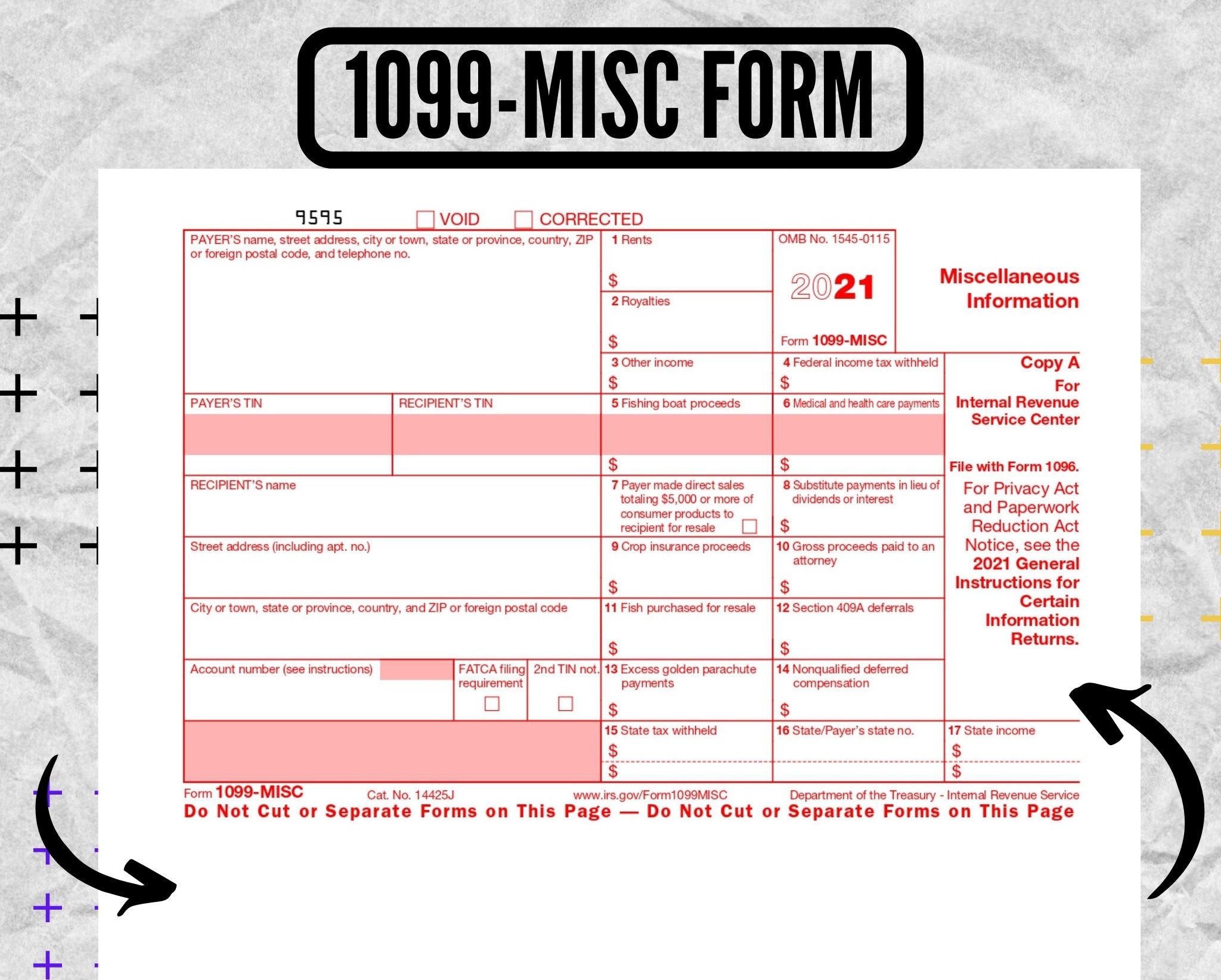

Form 1099 is a series of documents used to report various types of income other than wages, salaries, and tips. It is important for individuals and businesses to accurately report this income to the IRS. One of the most common types of Form 1099 is the 1099-MISC, which is used to report miscellaneous income such as freelance or contract work.

When it comes to tax time, having a printable version of Form 1099 can be incredibly helpful. This allows you to easily fill out the form and submit it to the IRS without any hassle. In this article, we will discuss the importance of Form 1099 printable and how you can obtain it.

Form 1099 Printable

Form 1099 printable is a convenient way to access and complete the necessary tax documents for reporting income. Whether you are a contractor, freelancer, or small business owner, having a printable version of Form 1099 can make the tax filing process much smoother. By having the form readily available, you can ensure that all income is accurately reported to the IRS.

There are various online resources where you can find a printable version of Form 1099. Many tax preparation websites offer free templates that you can download and fill out. Additionally, the IRS website provides access to printable versions of all Form 1099 documents. Make sure to choose the correct form based on the type of income you need to report.

Once you have obtained the printable Form 1099, take the time to carefully fill out all the required information. Make sure to accurately report all income and double-check your entries before submitting the form to the IRS. Keep a copy of the completed form for your records in case you need to refer back to it in the future.

In conclusion, having a printable version of Form 1099 can greatly simplify the tax reporting process for individuals and businesses. Make sure to access the correct form for your specific income type and accurately fill out all the necessary information. By utilizing a printable Form 1099, you can ensure compliance with IRS regulations and avoid any potential penalties for underreporting income.