As tax season approaches, it’s important to familiarize yourself with the various forms and documents required by the Internal Revenue Service (IRS). One such form that may be necessary for your tax filing is IRS Forms 2024. These forms are essential for reporting certain types of income or deductions, and having them on hand can help streamline the tax filing process.

IRS Forms 2024 printable are readily available online, making it easy for taxpayers to access and fill out these forms. Whether you’re a business owner, self-employed individual, or simply need to report specific financial transactions, having access to printable IRS Forms 2024 can be incredibly convenient.

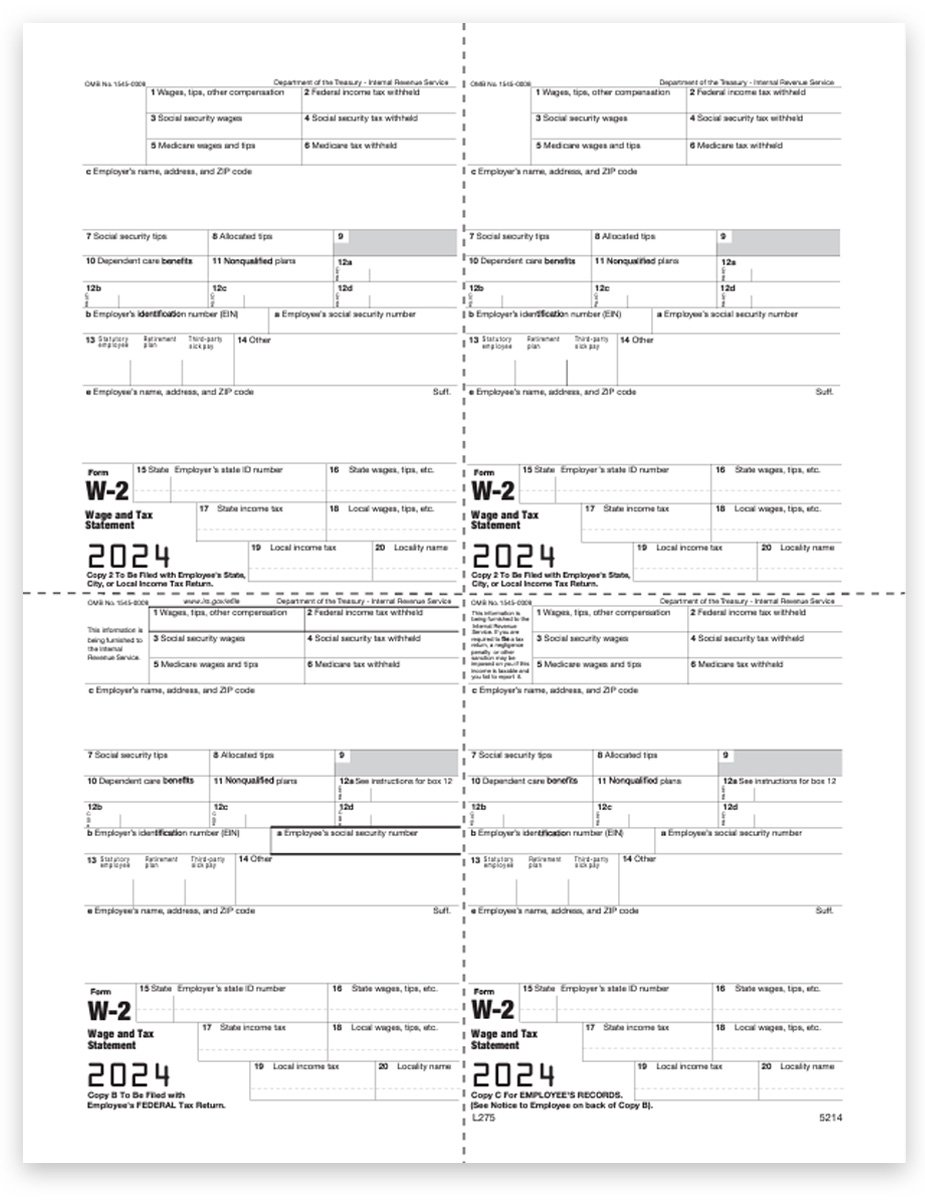

IRS Forms 2024 Printable

IRS Forms 2024 are used for reporting various types of income, deductions, and credits. These forms are essential for accurately reporting your financial information to the IRS and ensuring compliance with tax laws. By utilizing printable versions of these forms, taxpayers can easily fill them out at their convenience and avoid any potential errors that may arise from manual transcription.

One of the key benefits of using printable IRS Forms 2024 is the ability to access them from anywhere with an internet connection. This convenience allows taxpayers to complete their tax filings quickly and efficiently, without the need to visit a physical IRS office or request forms by mail.

Additionally, printable IRS Forms 2024 often come with instructions and guidelines to help taxpayers accurately complete the forms. This can be particularly helpful for individuals who are unfamiliar with tax laws or who may have questions about specific sections of the form.

Overall, utilizing printable IRS Forms 2024 can streamline the tax filing process and ensure that your financial information is reported accurately to the IRS. By taking advantage of these resources, taxpayers can avoid potential errors or discrepancies that may result in penalties or audits.

In conclusion, IRS Forms 2024 printable are essential documents for accurately reporting income, deductions, and credits to the IRS. By utilizing these forms, taxpayers can simplify the tax filing process and ensure compliance with tax laws. Make sure to access and fill out these forms correctly to avoid any potential issues with your tax return.