When tax season rolls around, many individuals find themselves searching for the necessary forms to file their taxes. One of the most commonly used forms is the IRS Form 1040, which is used to report an individual’s income and determine the amount of tax they owe. Fortunately, the IRS provides a printable version of Form 1040 on their website, making it easy for taxpayers to access and fill out.

Whether you prefer to file your taxes electronically or by mail, having a printable version of IRS Form 1040 can be incredibly helpful. This form is used to report various types of income, deductions, and credits, so having a physical copy on hand can make it easier to gather all the necessary information to accurately complete your tax return.

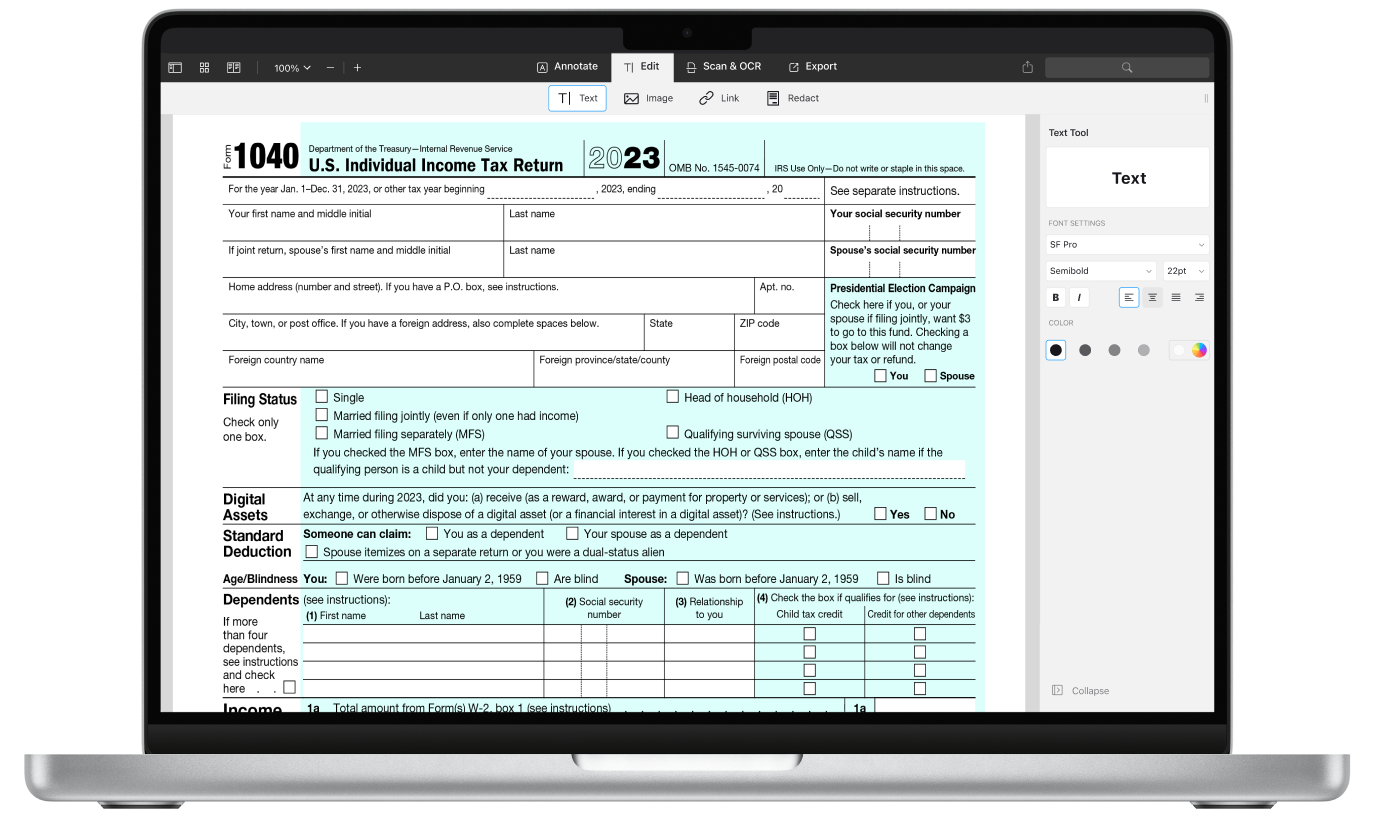

Printable IRS Form 1040

When filling out IRS Form 1040, it’s important to ensure that you have all the necessary documentation, such as W-2 forms, 1099 forms, and any other relevant financial records. The form is divided into sections for reporting income, deductions, credits, and other tax-related information. By following the instructions provided with the form, you can accurately report your financial information and calculate your tax liability.

One of the benefits of using the printable version of IRS Form 1040 is that you can work on it at your own pace and refer back to it as needed. This can be particularly useful if you have a complex tax situation or if you need to gather additional information before completing your return. Once you have filled out the form, you can either file it electronically using tax preparation software or print it out and mail it to the IRS.

Before submitting your completed IRS Form 1040, it’s important to review it carefully to ensure that all the information is accurate and complete. Any errors or omissions could lead to delays in processing your return or even trigger an audit. By taking the time to double-check your form before filing, you can help ensure that your tax return is processed efficiently and accurately.

In conclusion, having access to a printable version of IRS Form 1040 can make the process of filing your taxes much easier. By following the instructions provided with the form and carefully reviewing your completed return, you can accurately report your financial information and meet your tax obligations. So, don’t wait until the last minute – download a printable version of Form 1040 today and get started on your tax return!