As tax season approaches, it is important to familiarize yourself with the necessary forms for filing your taxes. One such form is the 1040 form, which is used by individuals to report their annual income to the Internal Revenue Service (IRS). The 1040 form is a crucial document in the tax-filing process, and understanding how to fill it out correctly is essential for avoiding any potential errors or penalties.

For the year 2023, the IRS has released the updated version of the 1040 form, which is available for taxpayers to download and print. The 1040 form for 2023 includes various sections where taxpayers must provide details about their income, deductions, and credits. It is important to carefully review the instructions for the 1040 form to ensure that you are accurately reporting all relevant information.

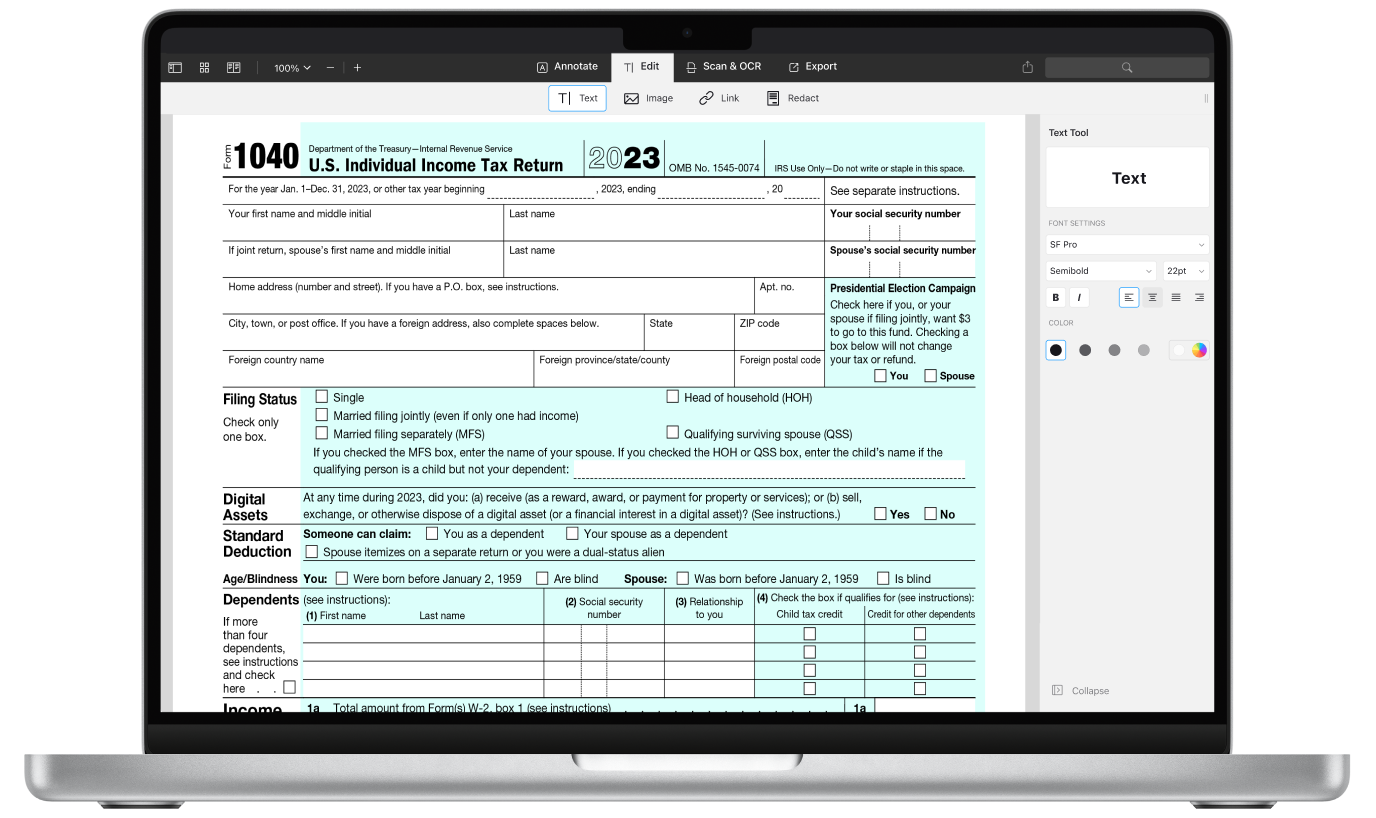

1040 Form 2023 Printable

The 1040 form for 2023 is available in a printable format on the IRS website, making it easy for taxpayers to access and fill out. The form can be downloaded and printed for free, allowing individuals to complete it at their convenience. It is important to use the most recent version of the 1040 form to ensure compliance with current tax laws and regulations.

When filling out the 1040 form for 2023, taxpayers must provide information about their income, including wages, salaries, tips, and any other sources of income. They must also report any deductions they are eligible for, such as student loan interest, mortgage interest, or charitable contributions. Additionally, taxpayers must claim any tax credits they qualify for, such as the Earned Income Credit or Child Tax Credit.

After completing the 1040 form, taxpayers must sign and date the document before submitting it to the IRS. It is important to double-check all information provided on the form to ensure accuracy and prevent any delays in processing. Once the form is submitted, taxpayers can expect to receive a refund if they have overpaid their taxes or make a payment if they owe additional taxes.

In conclusion, the 1040 form for 2023 is a critical document for individuals to file their taxes accurately and in compliance with IRS regulations. By understanding how to fill out the form correctly and utilizing the printable version available on the IRS website, taxpayers can navigate the tax-filing process with ease. Be sure to review the instructions carefully and seek assistance from a tax professional if needed to ensure a smooth tax-filing experience.