An amortization schedule is a table that shows the repayment of a loan over time, including the principal amount and interest. Using an Excel template can make creating and managing an amortization schedule much easier and more organized. With Excel’s powerful functions and formulas, you can customize the schedule to fit your specific loan terms and repayment plan.

By using an Excel template for your amortization schedule, you can easily track how much of each payment goes towards the principal and how much goes towards interest. This can help you visualize your progress in paying off the loan and understand the impact of different repayment scenarios.

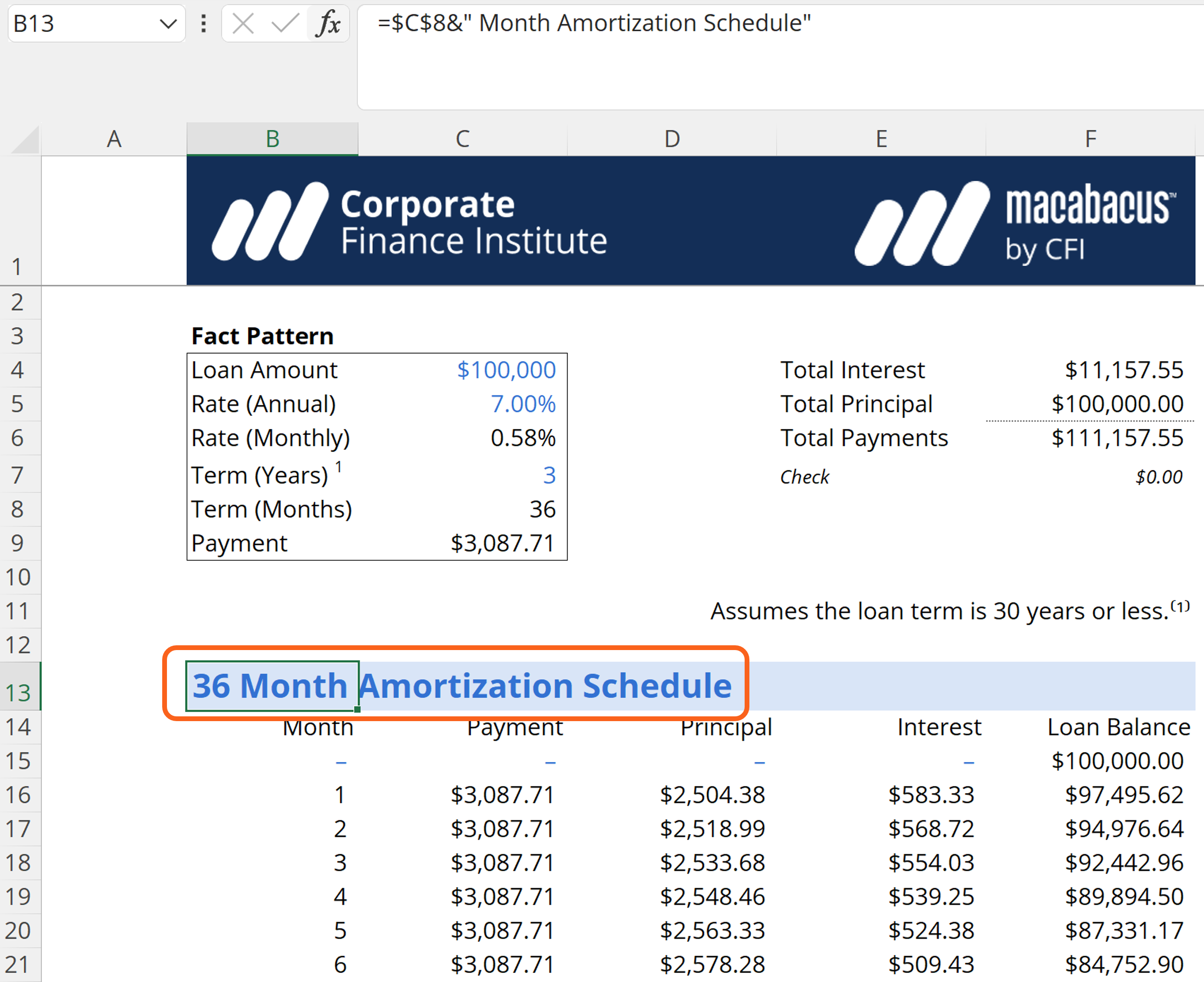

Creating an amortization schedule in Excel is simple and straightforward. You can input your loan amount, interest rate, loan term, and start date into the template, and Excel will automatically calculate the monthly payments, total interest paid, and remaining balance for each period. This can save you time and effort compared to manually calculating these numbers.

With Excel’s customization options, you can easily adjust the schedule to account for extra payments, changes in interest rates, or different loan terms. This flexibility allows you to see how different factors can affect your repayment schedule and make informed decisions about your loan repayment strategy.

Overall, using an Excel template for your amortization schedule can help you stay organized, track your progress, and make informed decisions about your loan repayment. Whether you’re a homeowner paying off a mortgage or a business owner managing a commercial loan, an Excel template can be a valuable tool in managing your debt effectively.

Take advantage of Excel’s powerful features and create an accurate and detailed amortization schedule to help you stay on track with your loan repayment goals. With the right template and a little bit of customization, you can easily manage your loan payments and make informed financial decisions.