Capital gains are profits that result from the sale of investments or assets such as stocks, bonds, real estate, or precious metals. When you sell an asset for more than you paid for it, you have a capital gain. These gains are subject to capital gains tax, which is calculated based on the difference between the purchase price and the selling price of the asset.

Capital gains carryover worksheet is a tool used by taxpayers to keep track of capital losses that exceed capital gains in a particular tax year. When you have more capital losses than gains, you can use the excess losses to offset gains in future years. This can help reduce your tax liability over time.

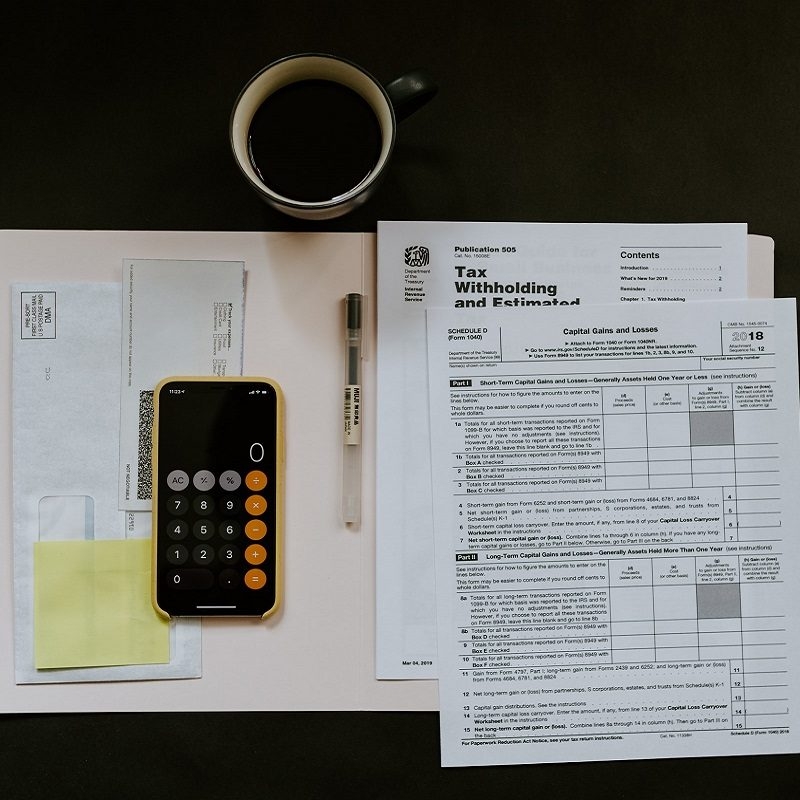

Capital Gains Carryover Worksheet

The capital gains carryover worksheet typically includes information such as the amount of capital gains and losses from the current year, any unused capital losses from previous years, and the total net capital gain or loss. This worksheet helps taxpayers calculate how much of their capital losses can be carried over to future tax years.

For example, if you have $5,000 in capital losses in a particular tax year but only $3,000 in capital gains, you can use the remaining $2,000 in losses to offset future gains. The capital gains carryover worksheet helps you keep track of these losses and ensures that you maximize their tax-saving potential.

It’s important to note that capital losses can only be used to offset capital gains, not other types of income such as wages or dividends. Additionally, there are limits on how much capital losses can be deducted in a single tax year. The capital gains carryover worksheet helps you stay organized and ensure that you are taking full advantage of any available tax benefits.

By carefully completing the capital gains carryover worksheet each year, you can potentially reduce your tax liability and save money in the long run. It’s a valuable tool for managing your investment portfolio and maximizing your tax efficiency.

In conclusion, the capital gains carryover worksheet is an essential tool for taxpayers looking to offset capital losses against gains in future tax years. By keeping track of your capital gains and losses and utilizing this worksheet effectively, you can minimize your tax burden and make the most of your investment strategy.