When it comes to calculating your capital gains tax, having a structured worksheet can make the process much easier. A capital gains tax worksheet helps you organize your financial information and determine the amount of tax you owe on any capital gains you have made.

Capital gains tax is the tax you pay on the profit you make from selling an asset such as stocks, real estate, or other investments. The tax rate can vary depending on how long you held the asset and your income bracket. Using a worksheet can help you track your gains and losses accurately.

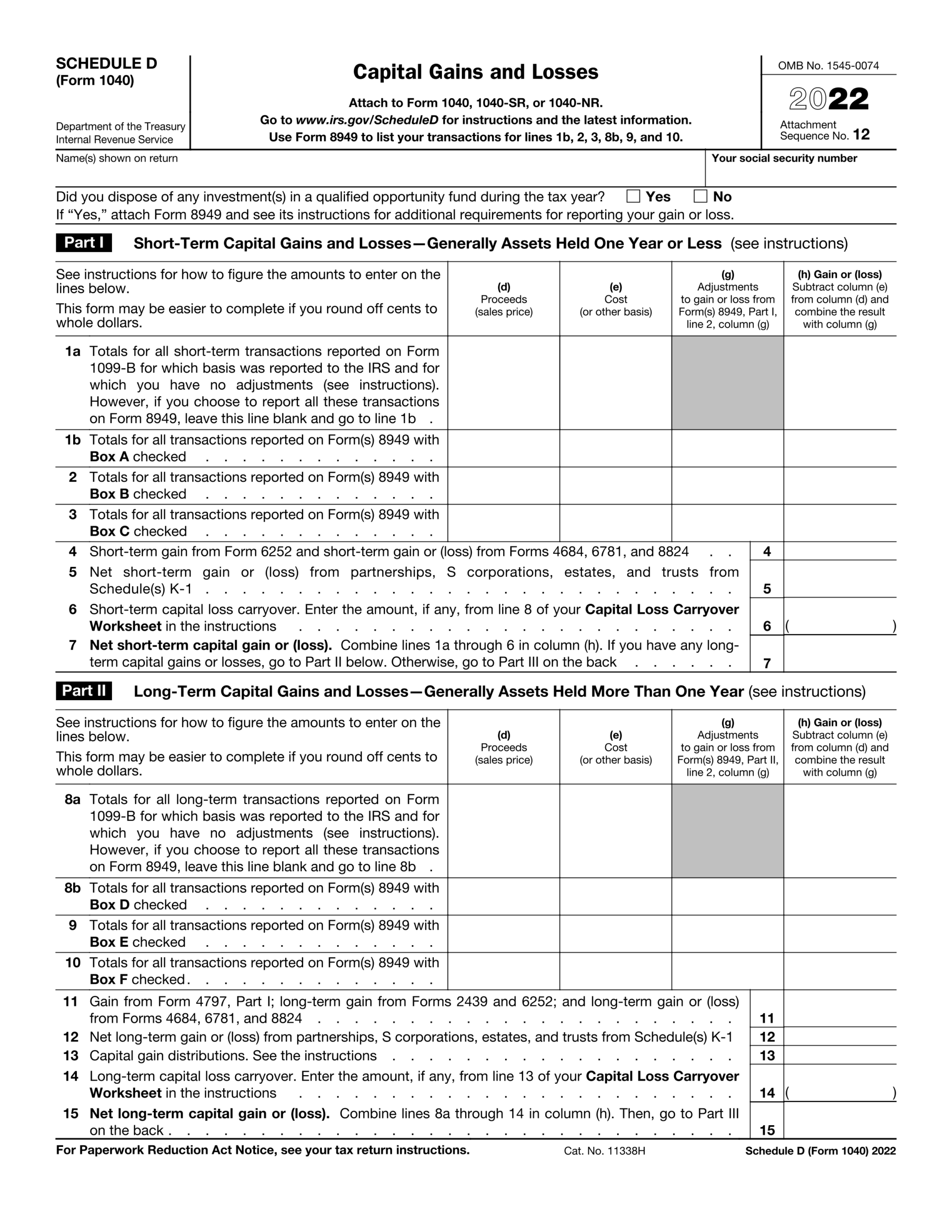

Capital Gains Tax Worksheet

Start by listing all the assets you have sold during the tax year. Include the purchase price, sale price, and any expenses incurred during the sale. This will give you the total gain or loss for each asset.

Next, calculate your total capital gains by adding up all the gains from each asset. Subtract any losses to get your net capital gains. This will be the amount you need to pay tax on.

Once you have your net capital gains, determine which tax rate applies to you based on how long you held the asset. Assets held for less than a year are subject to short-term capital gains tax, which is typically higher than long-term capital gains tax for assets held for more than a year.

Finally, use the capital gains tax rate that applies to your situation to calculate the tax you owe. Make sure to include this amount when filing your tax return to avoid any penalties or fines.

By using a capital gains tax worksheet, you can stay organized and ensure you are accurately reporting your gains and losses to the IRS. This can help you avoid any issues with the tax authorities and make the process of filing your taxes much smoother.

In conclusion, a capital gains tax worksheet is a valuable tool for anyone who has sold assets and wants to calculate their tax obligations. By following the steps outlined in the worksheet and accurately reporting your gains and losses, you can ensure you are compliant with tax laws and avoid any potential penalties. Make sure to keep detailed records of your transactions and consult with a tax professional if you have any questions about how to use the worksheet effectively.