When it comes to managing your finances and investments, understanding capital gains is crucial. A capital gains worksheet can help you calculate the gains or losses from selling an asset, such as stocks, real estate, or other investments. This worksheet is essential for tax purposes and can help you determine how much you owe in capital gains taxes.

Capital gains are the profits you make from selling an asset for more than you paid for it. These gains are subject to capital gains tax, which is calculated based on the difference between the purchase price and the selling price of the asset. By using a capital gains worksheet, you can track your gains and losses accurately and ensure you are compliant with tax regulations.

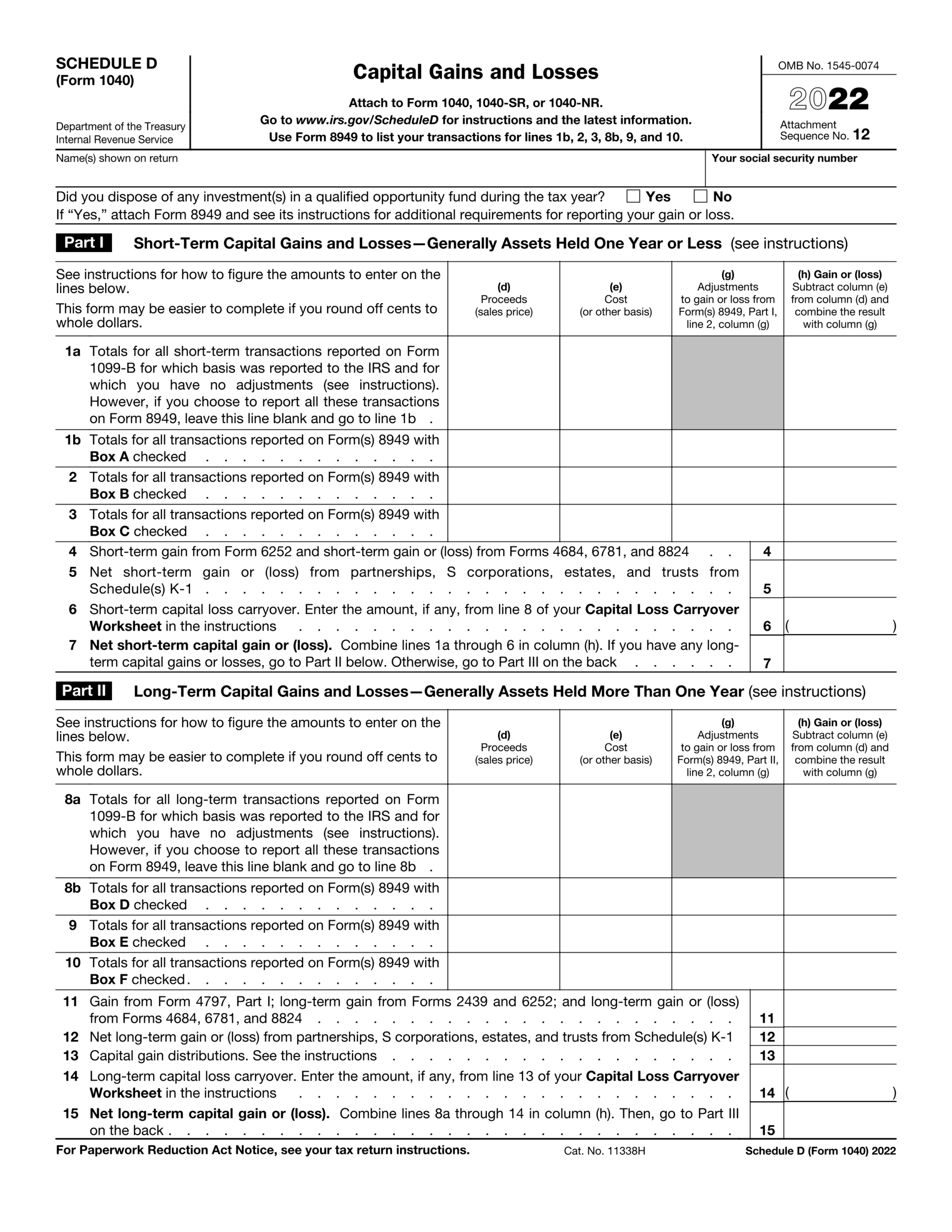

Capital Gains Worksheet

One of the key components of a capital gains worksheet is documenting the purchase price of the asset, the selling price, and any associated costs such as brokerage fees or commissions. You will also need to determine the holding period of the asset, as this can affect the tax rate applied to your gains.

Once you have gathered all the necessary information, you can calculate your capital gains by subtracting the purchase price from the selling price. If you have held the asset for more than a year, you may qualify for long-term capital gains tax rates, which are typically lower than short-term capital gains tax rates.

It is important to keep accurate records of your capital gains and losses throughout the year, as this information will be needed when filing your taxes. By using a capital gains worksheet, you can stay organized and ensure you are maximizing your tax savings while remaining compliant with tax laws.

In conclusion, a capital gains worksheet is a valuable tool for investors and individuals looking to manage their finances effectively. By keeping track of your gains and losses, you can make informed decisions about your investments and minimize your tax liability. Utilize a capital gains worksheet to stay organized and on top of your financial goals.