When it comes to managing your finances and investments, understanding capital loss carryovers is essential. A capital loss carryover allows you to offset capital gains in future years, helping you reduce your tax liability. The Capital Loss Carryover Worksheet for 2023 is a tool that helps you calculate and keep track of these losses for the upcoming tax year.

By utilizing the Capital Loss Carryover Worksheet 2023, you can ensure that you are maximizing your tax benefits and minimizing your tax obligations. It is important to accurately document your capital losses from previous years to take advantage of this tax-saving strategy.

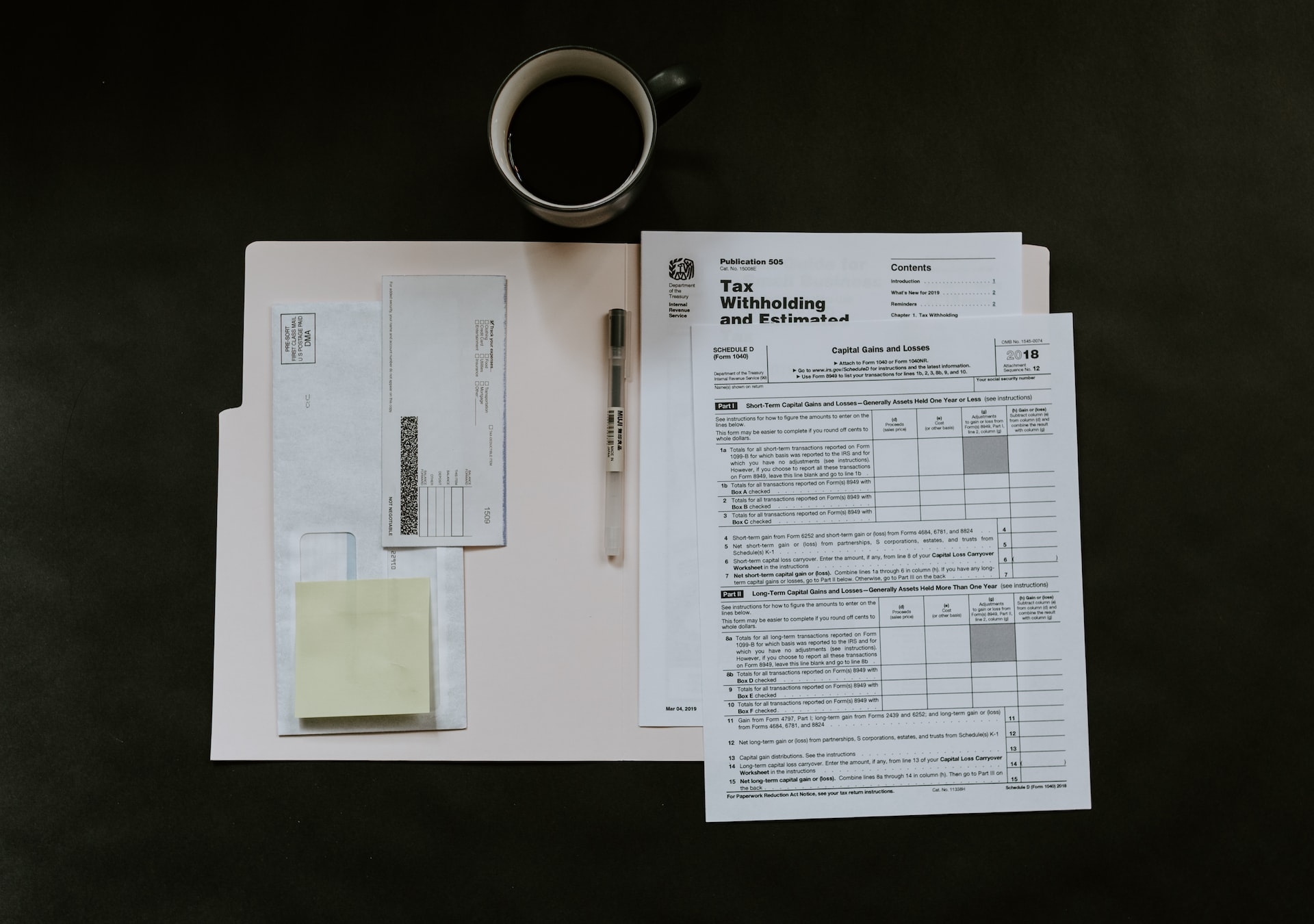

Capital Loss Carryover Worksheet 2023

The Capital Loss Carryover Worksheet for 2023 is a document provided by the Internal Revenue Service (IRS) that helps taxpayers calculate their capital losses from previous years and determine the amount that can be carried forward to offset capital gains in the current tax year. This worksheet is essential for individuals who have experienced losses in their investment portfolios and want to use those losses to reduce their tax burden.

When completing the Capital Loss Carryover Worksheet 2023, it is important to accurately input the information from your previous tax returns and investment statements. By carefully following the instructions provided on the worksheet, you can calculate the amount of capital losses that can be carried over to future years.

Once you have determined the amount of capital losses that can be carried forward, you can use this information to reduce your taxable income in the current tax year. This can result in significant tax savings and help you make the most of your investment losses.

Overall, the Capital Loss Carryover Worksheet 2023 is a valuable tool for individuals looking to minimize their tax liability and maximize their investment returns. By carefully documenting and calculating your capital losses, you can take advantage of this tax-saving strategy and improve your overall financial situation.

In conclusion, the Capital Loss Carryover Worksheet for 2023 is an important document for individuals who have experienced investment losses in previous years. By utilizing this worksheet, you can effectively manage your capital losses and reduce your tax obligations in the upcoming tax year. Make sure to consult with a tax professional or financial advisor if you have any questions or need assistance with completing the worksheet.