Creating a budget worksheet is an essential step towards managing your finances effectively. It allows you to track your income and expenses, identify areas where you can cut back, and ultimately help you reach your financial goals.

Whether you are looking to save for a big purchase, pay off debt, or simply gain a better understanding of your spending habits, a budget worksheet can be a valuable tool in achieving financial stability.

How to Create a Budget Worksheet

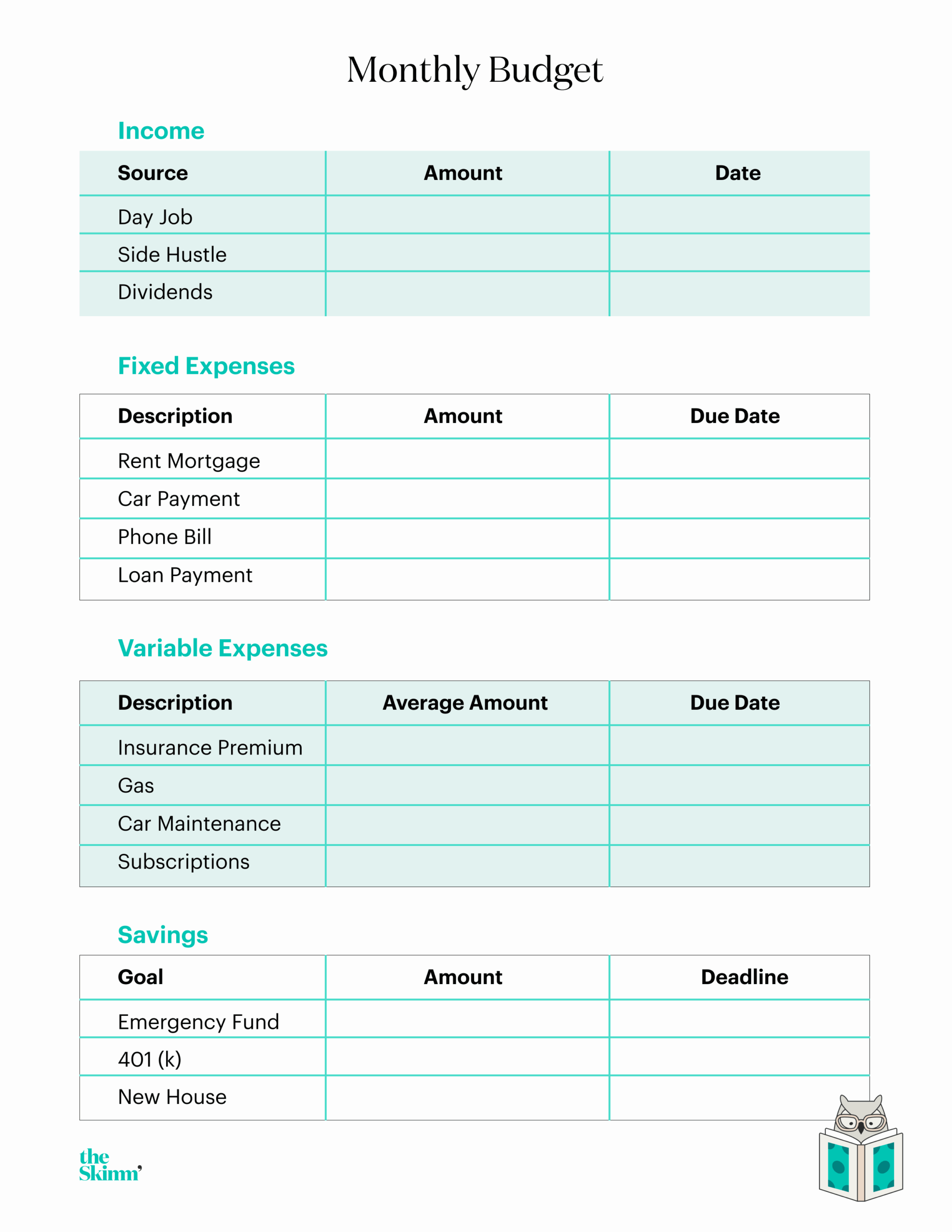

1. Start by listing all of your sources of income. This may include your salary, bonuses, rental income, or any other money that comes in regularly. Be sure to include the amount and frequency of each income source.

2. Next, list all of your expenses. This can include bills, groceries, transportation costs, entertainment expenses, and any other regular or one-time expenses. Be as detailed as possible to get an accurate picture of your spending habits.

3. Subtract your total expenses from your total income to determine whether you have a surplus or a deficit. If you have a surplus, consider allocating it towards savings or debt repayment. If you have a deficit, look for areas where you can cut back on spending.

4. Update your budget worksheet regularly to reflect any changes in your income or expenses. This will help you stay on track and make adjustments as needed to reach your financial goals.

5. Be realistic with your budgeting goals. It’s important to set achievable targets that will help you stay motivated and committed to sticking to your budget. Remember, small changes can add up to big savings over time.

Creating a budget worksheet may seem daunting at first, but it is a powerful tool that can help you take control of your finances and create a solid foundation for a secure financial future.