Managing debt can be a challenging task, especially when you have multiple loans or credit lines to keep track of. This is where a debt schedule Excel template can be incredibly helpful. By using a template, you can organize your debts, track your payments, and create a plan to pay off your debts efficiently.

One of the main benefits of using a debt schedule Excel template is that it allows you to see all of your debts in one place. This can help you get a clear picture of your financial situation and prioritize which debts to pay off first. Additionally, the template can calculate your total debt, interest payments, and remaining balance, making it easier to create a repayment plan.

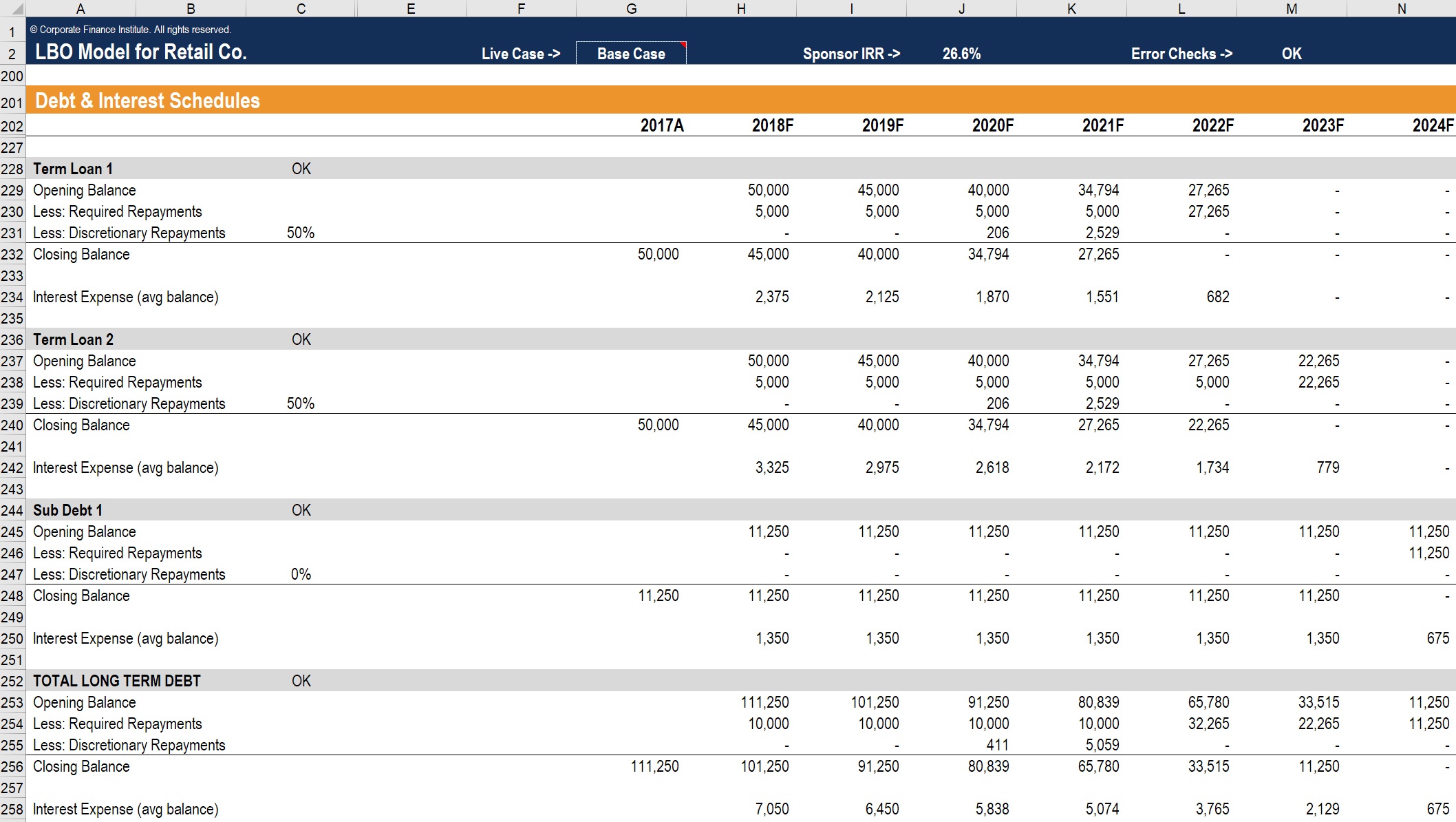

Debt Schedule Excel Template

When using a debt schedule Excel template, you can input information such as the loan amount, interest rate, monthly payment, and term of the loan. The template will then automatically calculate the total interest paid, total payments made, and remaining balance for each debt. This can help you see how much you owe and how long it will take to pay off each debt.

Another advantage of using a debt schedule Excel template is that it can help you track your progress towards debt repayment goals. By regularly updating the template with your payments, you can see how much closer you are to becoming debt-free. This can be a motivating factor to stick to your repayment plan and make extra payments when possible.

In addition, a debt schedule Excel template can be customized to suit your specific financial situation. You can add or remove columns, change the formatting, or create graphs to visualize your debt repayment progress. This flexibility allows you to tailor the template to meet your needs and make it easier to manage your debts.

Overall, a debt schedule Excel template is a valuable tool for anyone looking to take control of their finances and pay off debt. By using a template, you can organize your debts, track your payments, and create a plan to become debt-free. So why not give it a try and see how it can help you achieve your financial goals?

In conclusion, a debt schedule Excel template is a useful tool for managing and paying off debt. By using a template, you can track your debts, calculate interest payments, and create a repayment plan. Take advantage of this resource to take control of your finances and work towards becoming debt-free.