When it comes to managing your finances, understanding deductions is crucial. A deductions worksheet can help you keep track of all the expenses you can deduct from your taxable income, ultimately saving you money in the long run.

Whether you’re self-employed or have a traditional job, knowing what deductions you qualify for can make a significant difference in how much you owe in taxes. By utilizing a deductions worksheet, you can ensure that you are maximizing your deductions and not missing out on any potential savings.

What is a Deductions Worksheet?

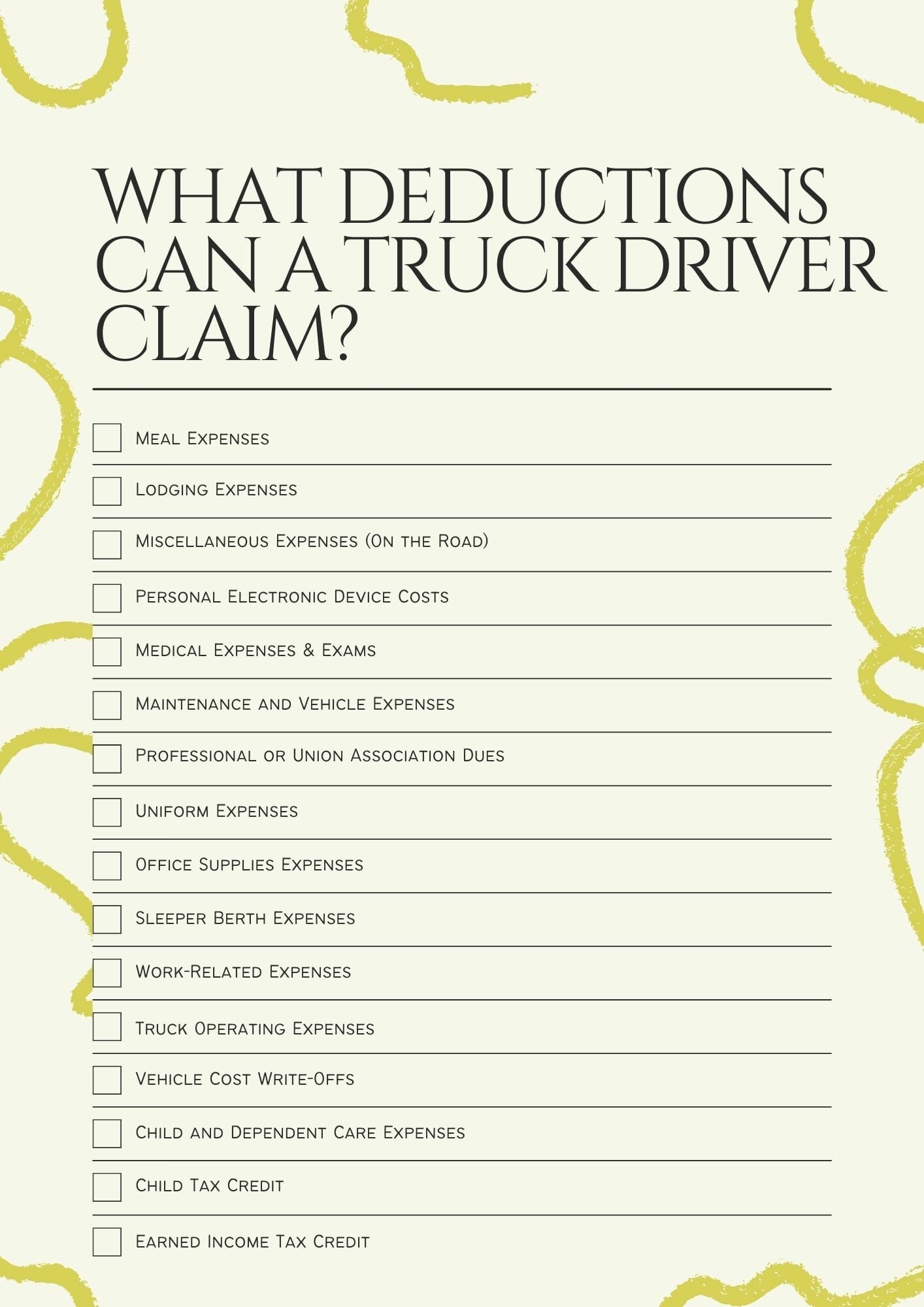

A deductions worksheet is a tool used to track and calculate the expenses that can be deducted from your taxable income. These expenses can include business expenses, educational expenses, medical expenses, and more. By documenting these deductions on a worksheet, you can easily reference them when filing your taxes and ensure that you are taking full advantage of all available deductions.

One of the key benefits of using a deductions worksheet is that it can help you stay organized throughout the year. By keeping track of your deductible expenses as they occur, you can avoid the last-minute scramble to gather all the necessary documentation when tax season rolls around. This proactive approach can save you time and stress in the long run.

In addition to helping you maximize your deductions, a deductions worksheet can also serve as a valuable financial planning tool. By seeing where your money is going and which expenses are deductible, you can make more informed decisions about your spending habits and potentially identify areas where you can cut costs.

Overall, a deductions worksheet is a valuable resource for anyone looking to take control of their finances and save money on their taxes. By keeping track of deductible expenses and staying organized throughout the year, you can ensure that you are making the most of all available deductions and ultimately keep more money in your pocket.

In conclusion, utilizing a deductions worksheet can help you navigate the complex world of tax deductions and save money in the process. By documenting your deductible expenses and staying organized throughout the year, you can ensure that you are maximizing your deductions and minimizing your tax liability. So, take the time to create a deductions worksheet and start saving today!