When it comes to taxes and financial documentation, the W-9 form is an essential tool for businesses and individuals alike. This form is used to collect information from vendors, independent contractors, and freelancers who will be paid for their services. It provides necessary details such as the recipient’s name, address, and taxpayer identification number (TIN).

Having a completed and accurate W-9 form on file ensures that businesses can report payments accurately to the IRS and issue Form 1099 to the recipient. This form helps to prevent underreporting of income and ensures that all parties are compliant with tax regulations.

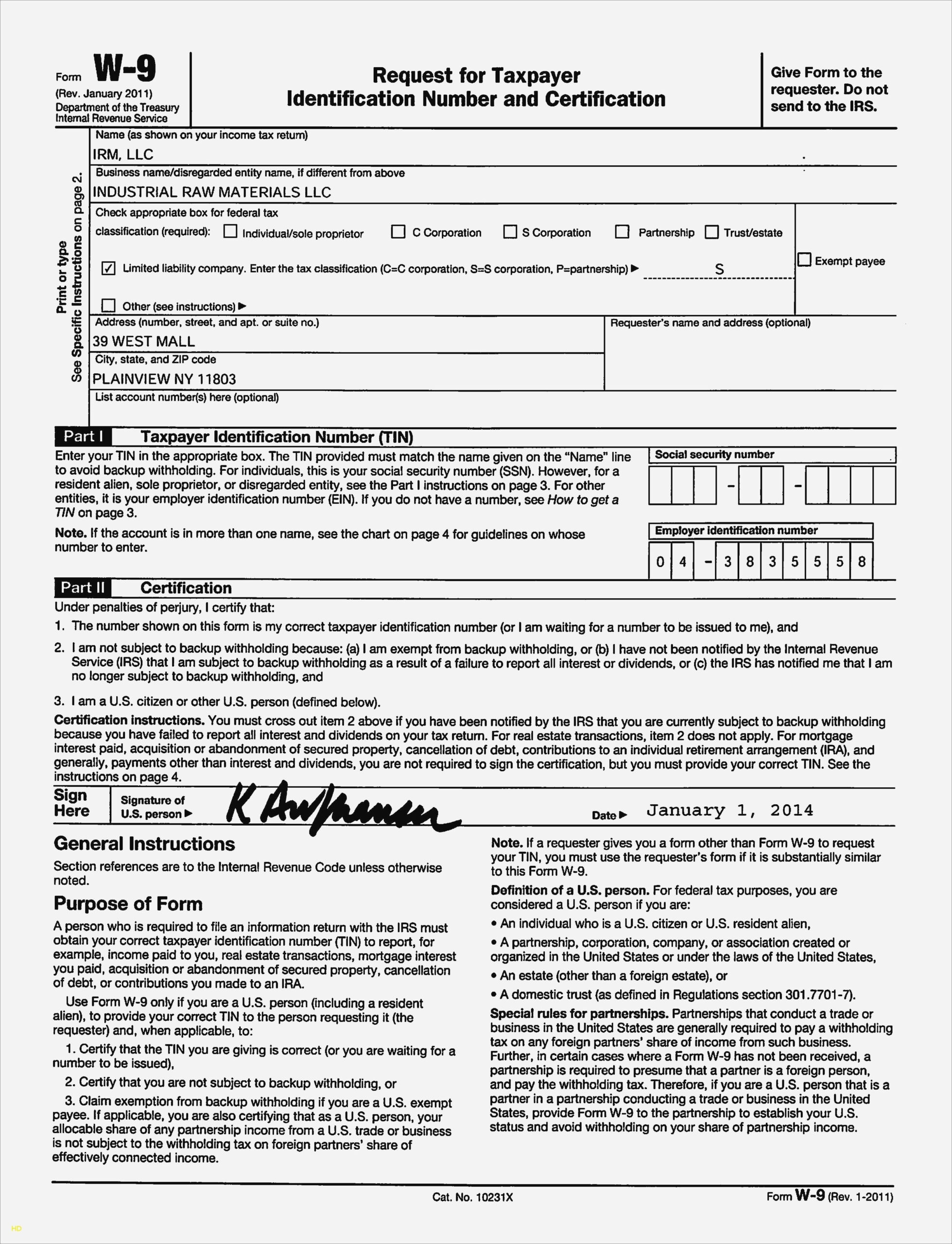

Free Printable W-9 Form

For those in need of a W-9 form, finding a free printable version online can be a convenient solution. There are several websites that offer downloadable and printable W-9 forms that can be easily filled out and submitted as needed.

One popular option is the IRS website, which provides a fillable PDF version of the W-9 form that can be completed online or printed out for manual completion. This official form ensures that all required information is included and can be submitted with confidence.

In addition to the IRS website, there are also third-party websites that offer free printable W-9 forms. These sites may provide additional resources and guidance for completing the form correctly, making the process even easier for users.

By utilizing a free printable W-9 form, businesses and individuals can streamline their documentation processes and ensure that all necessary information is collected accurately. This can help to avoid delays in payments and ensure that tax reporting requirements are met in a timely manner.

Conclusion

In conclusion, the W-9 form is a crucial document for businesses and individuals when it comes to reporting payments and ensuring compliance with tax regulations. By using a free printable W-9 form, users can simplify the process of collecting and submitting this important information, making it easier to stay organized and compliant with IRS requirements.