When it comes to filing taxes, having the necessary forms on hand is essential. The Internal Revenue Service (IRS) provides a variety of printable forms that taxpayers can use to report their income, deductions, and credits. These forms are easily accessible on the IRS website and can be downloaded and printed for free. Whether you are an individual taxpayer or a business owner, having the right forms is crucial for accurately reporting your tax information.

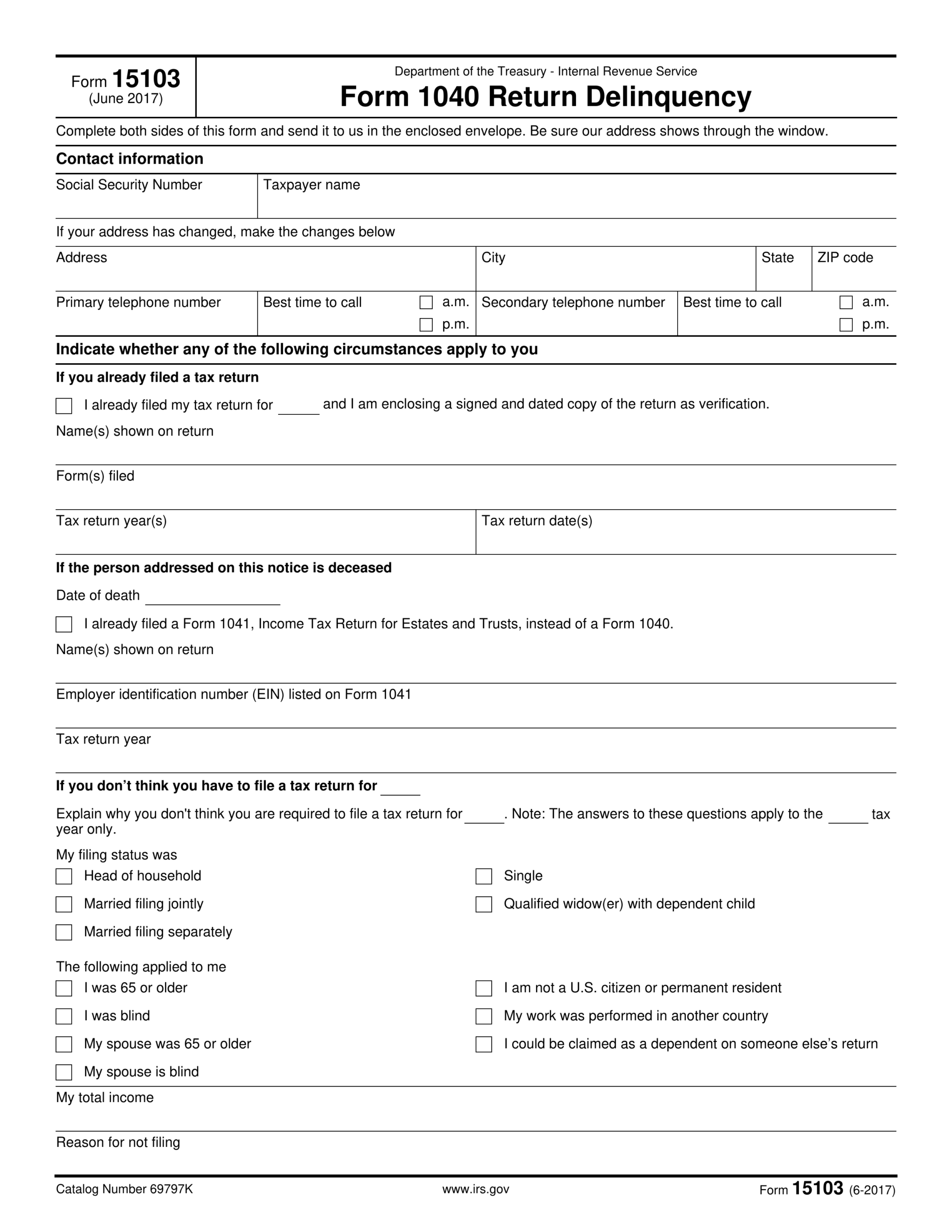

IRS printable forms cover a wide range of tax-related topics, including income tax returns, employment taxes, and information returns. From Form 1040 for individual income tax returns to Form W-2 for reporting wages and salaries, there is a form for every tax situation. By using these printable forms, taxpayers can ensure that they are providing the IRS with the necessary information to calculate their tax liability accurately.

IRS Printable Forms

One of the most commonly used IRS printable forms is Form 1040, which is used by individuals to report their annual income and claim deductions and credits. This form is available in several variations, depending on the taxpayer’s filing status and income level. Other popular forms include Form 1099 for reporting income from sources other than wages, and Form W-4 for determining the amount of federal income tax to withhold from an employee’s paycheck.

For businesses, IRS printable forms are essential for reporting income, expenses, and other financial information. Forms such as 941 for reporting quarterly employment taxes, and 1120 for filing corporate income tax returns, are necessary for complying with tax laws. By using these forms correctly, businesses can avoid penalties and ensure that they are meeting their tax obligations.

IRS printable forms are designed to be easy to understand and fill out, making the tax filing process less daunting for taxpayers. Many forms also come with instructions that provide guidance on how to complete them accurately. Additionally, the IRS website offers resources such as publications and FAQs to help taxpayers navigate the tax system and find answers to common questions.

In conclusion, IRS printable forms are a valuable resource for taxpayers who need to report their income and pay their taxes. By using these forms, individuals and businesses can ensure that they are complying with tax laws and avoiding penalties. Whether you are filing your taxes for the first time or are a seasoned taxpayer, having the right forms on hand is essential for a successful tax filing experience.