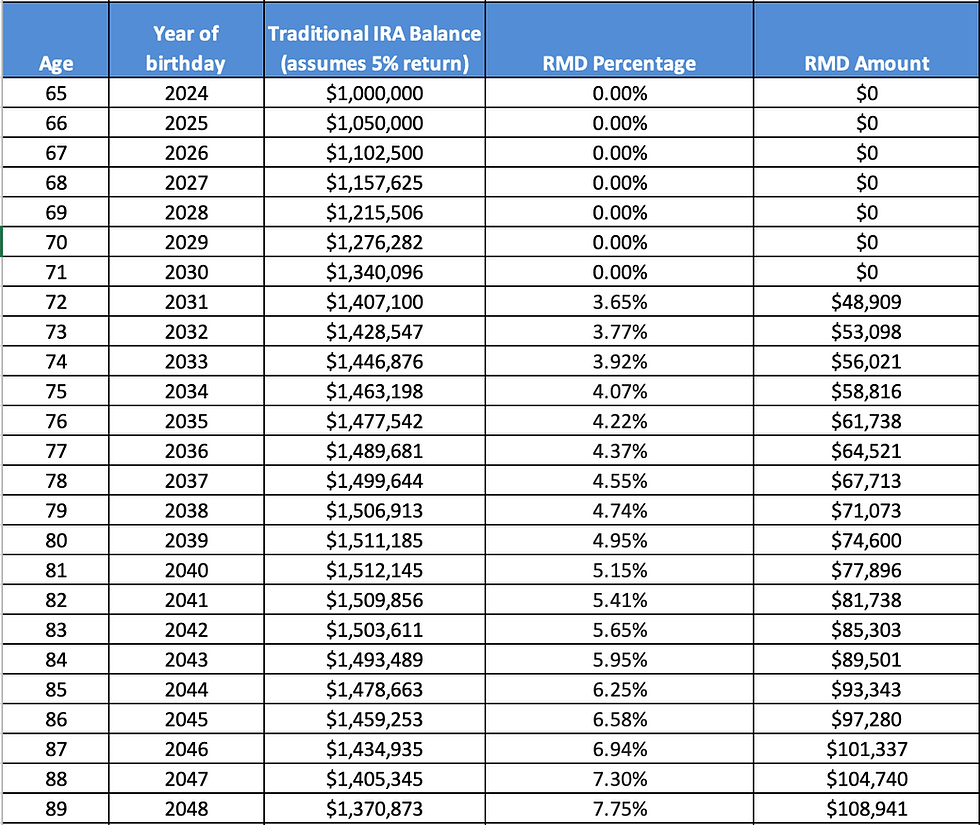

When it comes to retirement savings, it’s important to be aware of the rules and regulations set forth by the IRS. One key aspect of retirement planning is the Required Minimum Distribution (RMD), which is the minimum amount that must be withdrawn from a retirement account each year once you reach a certain age. The IRS has specific guidelines for calculating your RMD, and one tool that can help you determine this amount is the IRS RMD Worksheet.

The IRS RMD Worksheet is a handy tool provided by the IRS to help individuals calculate the required minimum distribution they must take from their retirement accounts each year. This worksheet takes into account factors such as your age, account balance, and life expectancy to determine the amount you are required to withdraw. By using this worksheet, you can ensure that you are meeting the IRS requirements for RMDs and avoid any penalties for not taking the correct amount.

Using the IRS RMD Worksheet

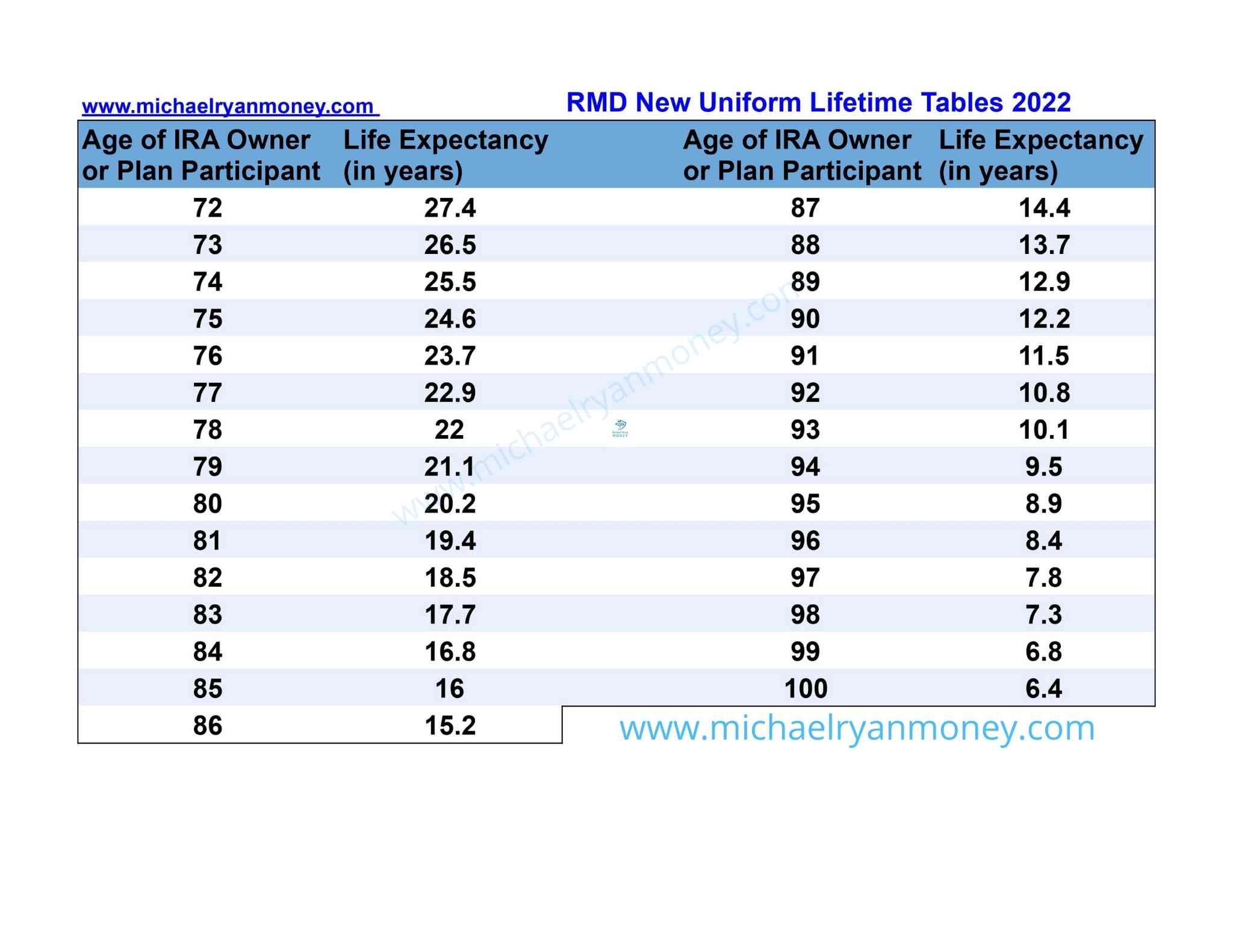

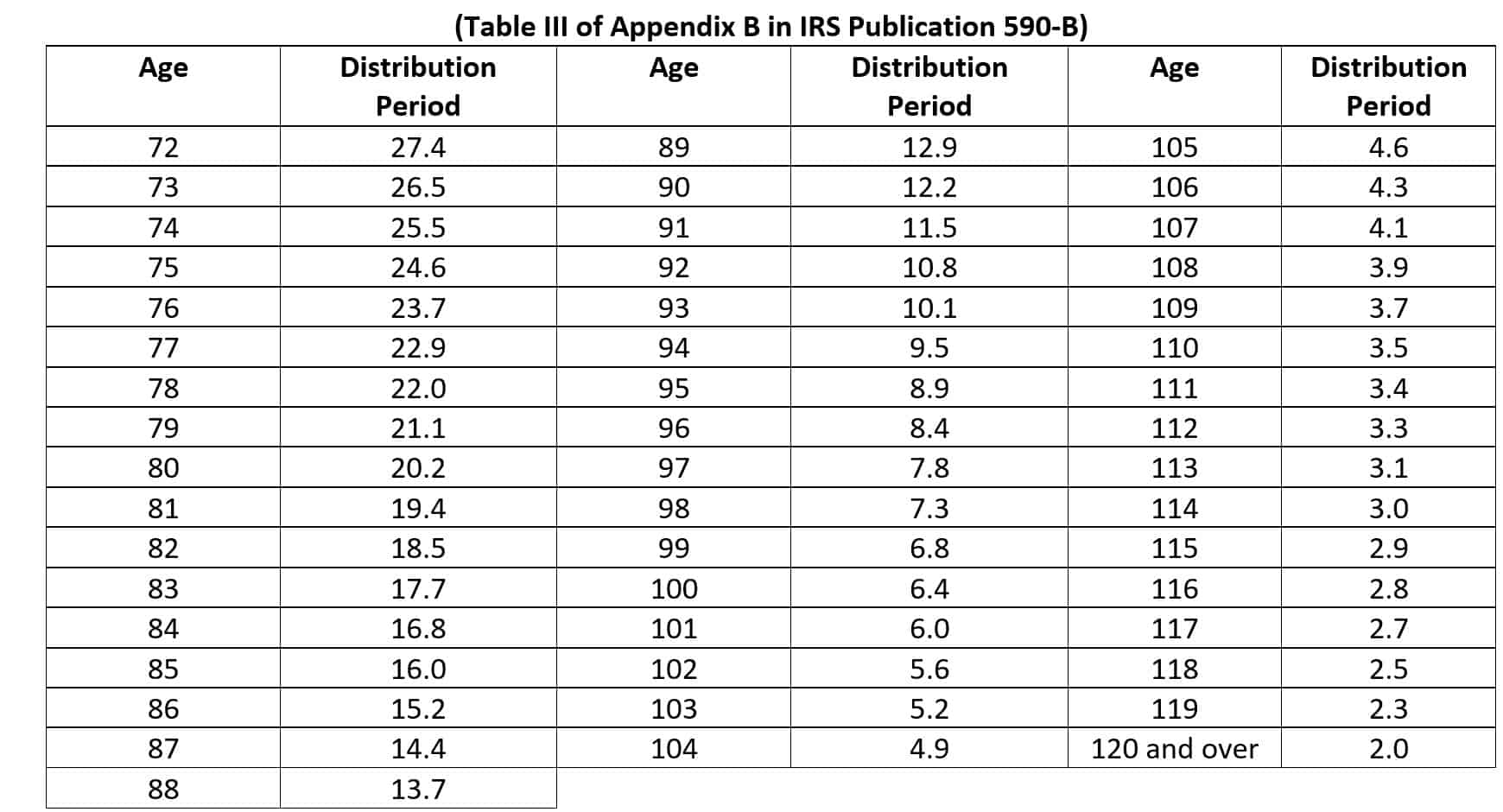

When using the IRS RMD Worksheet, you will need to gather information such as the balance of your retirement accounts, your age, and your designated beneficiary’s age. You will also need to know the distribution period based on your life expectancy, which can be found in IRS Publication 590-B. Once you have this information, you can follow the instructions on the worksheet to calculate your RMD for the year.

It’s important to note that the IRS RMD Worksheet is just one method for calculating your required minimum distribution. There are other methods available, such as using online calculators or working with a financial advisor. However, the IRS worksheet is a simple and straightforward way to ensure that you are meeting the IRS requirements for RMDs.

Once you have calculated your RMD using the IRS worksheet, you will need to make sure that you take the required distribution by the deadline set by the IRS. Failure to do so can result in hefty penalties, so it’s important to stay on top of your RMD requirements each year. By using tools like the IRS RMD Worksheet, you can make this process easier and ensure that you are in compliance with IRS regulations.

In conclusion, the IRS RMD Worksheet is a valuable tool for individuals who are required to take minimum distributions from their retirement accounts. By using this worksheet, you can accurately calculate your RMD each year and avoid any penalties for non-compliance. Be sure to consult with a financial advisor or tax professional if you have any questions about your RMD requirements or how to use the IRS worksheet effectively.