When it comes to taxes and deductions, the IT 2104 worksheet plays a crucial role in helping individuals determine how much they should withhold from their paychecks. This form is used to calculate the correct amount of state income tax that should be withheld based on various factors such as filing status, dependents, and additional income.

It is important for individuals to accurately fill out the IT 2104 worksheet to avoid overpaying or underpaying their taxes throughout the year. By properly completing this form, individuals can ensure that they are withholding the correct amount of state income tax and avoid any surprises come tax season.

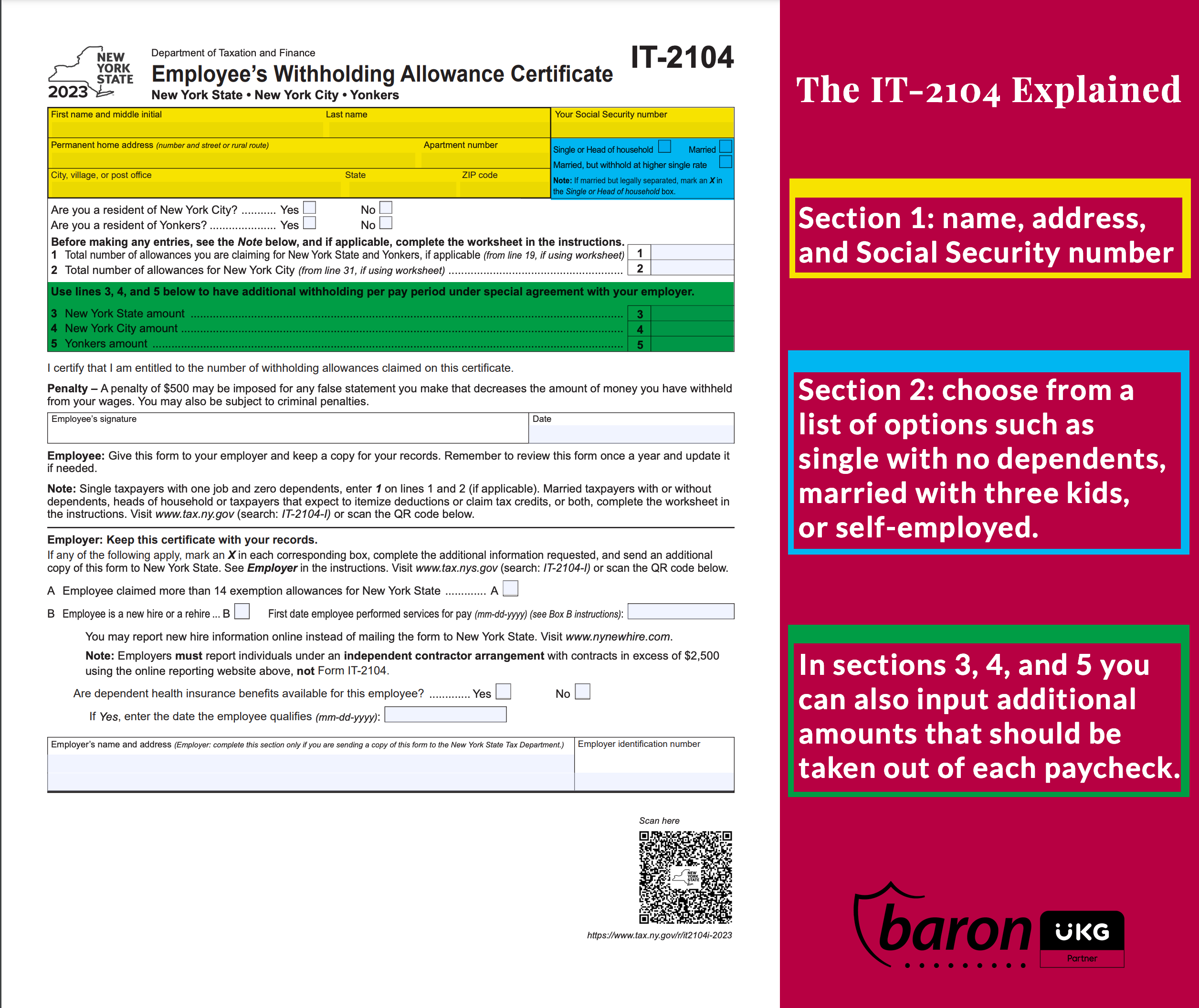

Understanding the Components of the IT 2104 Worksheet

The IT 2104 worksheet typically consists of sections where individuals need to provide information such as their filing status, number of dependents, and any additional income they may have. These factors are used to calculate the appropriate amount of state income tax that should be withheld from each paycheck.

Additionally, individuals may need to consider any deductions or credits that they are eligible for when completing the IT 2104 worksheet. By taking these into account, individuals can further adjust their withholding amounts to ensure they are not overpaying on their taxes.

It is recommended that individuals review and update their IT 2104 worksheet annually or whenever there are significant changes in their financial situation. This will help ensure that they are withholding the correct amount of state income tax and avoid any potential penalties or surprises at tax time.

In conclusion, the IT 2104 worksheet is a valuable tool for individuals to use when determining the appropriate amount of state income tax to withhold from their paychecks. By accurately completing this form and considering all relevant factors, individuals can better manage their tax obligations and avoid any unnecessary complications in the future.