Managing finances can be challenging, especially for those on a low income. However, creating a budget is essential to ensure that you are able to meet your financial goals and avoid falling into debt. A printable budget worksheet can be a useful tool for beginners to track their expenses and income effectively.

With a simple and easy-to-use budget worksheet, you can take control of your finances and make informed decisions about where your money is going. This can help you identify areas where you can cut back on expenses and save money for the future.

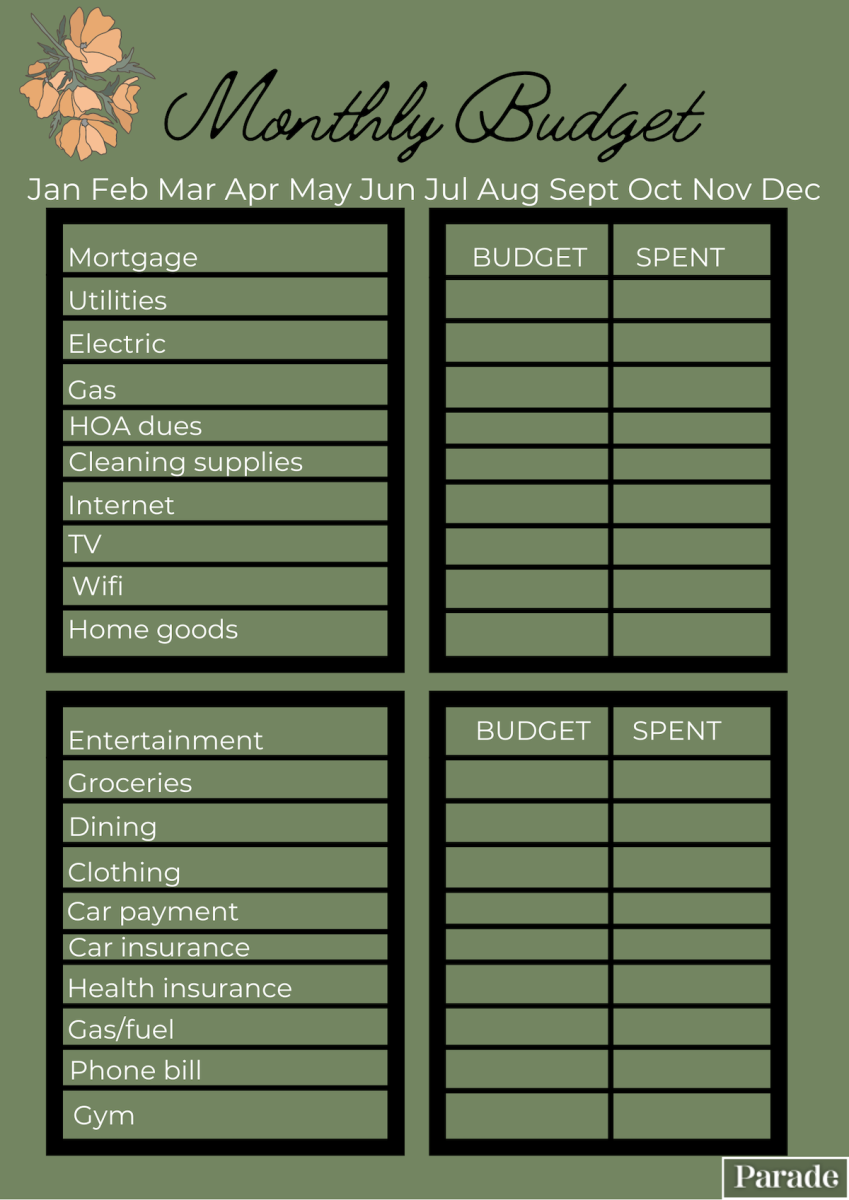

Low Income Budget Beginner Printable Budget Worksheet

When creating a budget worksheet for beginners on a low income, it is important to start by listing all sources of income, including wages, benefits, and any other sources of money coming in. Next, list all expenses, including rent, utilities, groceries, transportation, and any other bills that need to be paid.

Once you have listed all your income and expenses, subtract the total expenses from the total income to determine how much money you have left over each month. This will give you a clear picture of your financial situation and help you make adjustments as needed.

It is important to review your budget worksheet regularly and make changes as necessary. If you find that you are consistently spending more than you are earning, you may need to look for ways to increase your income or cut back on expenses. By tracking your spending and income, you can make informed decisions about your finances and work towards your financial goals.

Using a printable budget worksheet can help beginners on a low income take control of their finances and plan for the future. By tracking expenses and income, you can make informed decisions about where your money is going and make adjustments as needed. With a little time and effort, you can create a budget that works for you and helps you achieve your financial goals.

In conclusion, a printable budget worksheet can be a valuable tool for beginners on a low income to manage their finances effectively. By tracking expenses and income, you can take control of your financial situation and make informed decisions about your money. With a clear budget in place, you can work towards your financial goals and build a secure financial future.