Managing your finances effectively is crucial for achieving financial stability and reaching your financial goals. One of the best tools to help you keep track of your income and expenses is a personal budget worksheet. This simple yet powerful tool can help you gain a clear understanding of your financial situation and make informed decisions about your spending and saving habits.

Creating a personal budget worksheet is a straightforward process that can have a significant impact on your financial well-being. By documenting your income sources, expenses, and savings goals in one central location, you can easily monitor your financial progress and identify areas where you may need to make adjustments.

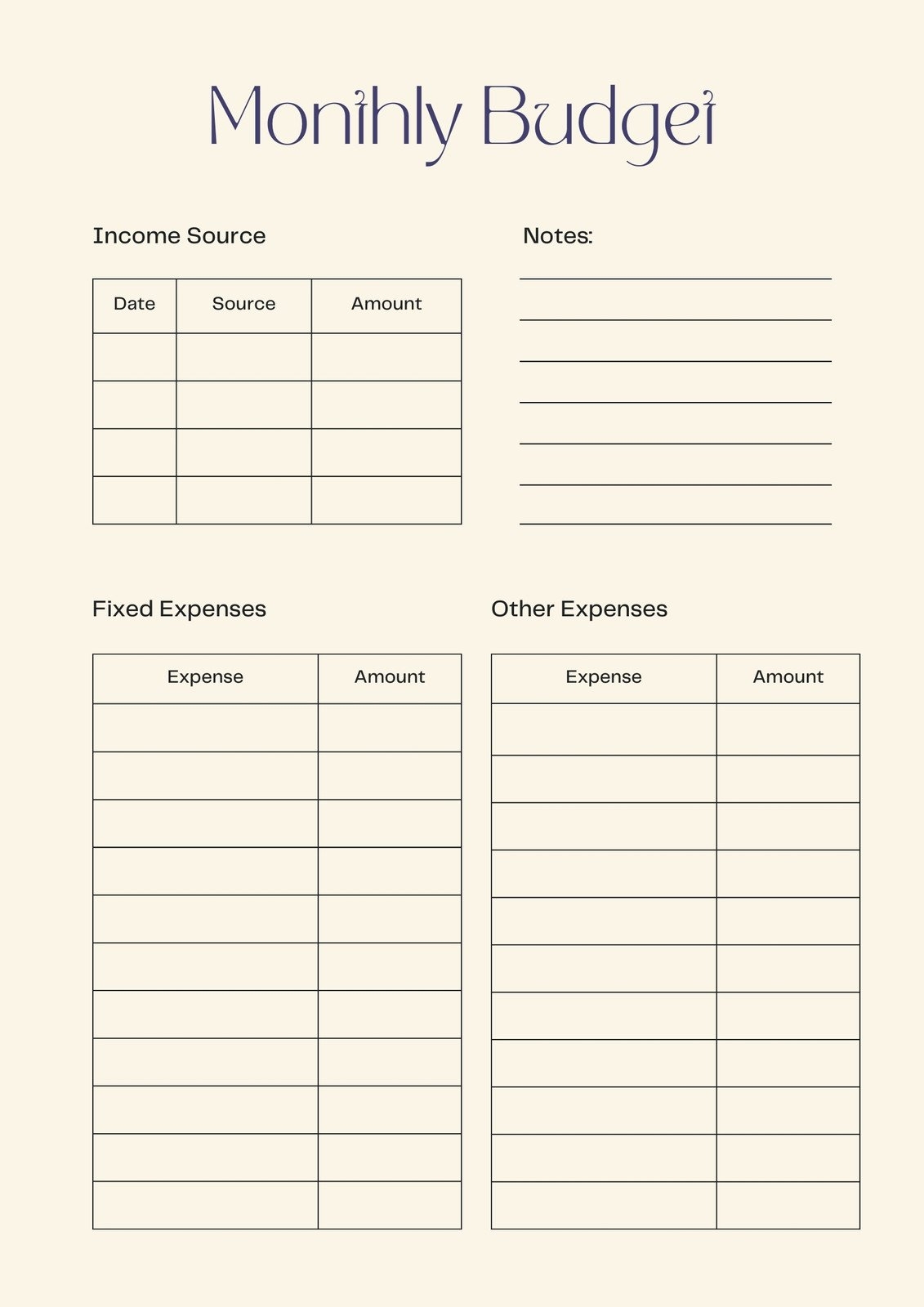

Personal Budget Worksheet

A personal budget worksheet typically consists of several sections, including income, expenses, savings goals, and a summary of your financial situation. Start by listing all sources of income, such as your salary, bonuses, and any additional sources of revenue. Next, document your monthly expenses, including rent or mortgage payments, utilities, groceries, transportation, and entertainment costs.

Once you have listed all your income and expenses, calculate the difference between the two to determine your monthly savings or deficit. If you find that you are spending more than you earn, you may need to make adjustments to your spending habits or find ways to increase your income. Setting savings goals can help you prioritize your financial objectives and work towards achieving them.

Regularly updating your personal budget worksheet can help you stay on track with your financial goals and avoid overspending. By reviewing your budget periodically, you can make informed decisions about your finances and adjust your spending habits as needed. Additionally, tracking your progress can provide motivation and encouragement as you work towards achieving your financial objectives.

In conclusion, a personal budget worksheet is a valuable tool for managing your finances effectively and achieving your financial goals. By documenting your income, expenses, and savings goals in one central location, you can gain a clear understanding of your financial situation and make informed decisions about your financial future. Take the time to create a personal budget worksheet and start taking control of your finances today.