When unforeseen circumstances make it difficult for tenants to pay rent on time, a rent repayment plan can be a helpful solution. This plan allows tenants to make smaller, more manageable payments over a period of time, rather than facing eviction. By creating a formal agreement with your landlord, you can ensure that both parties are on the same page regarding the repayment schedule.

It’s important to approach your landlord with honesty and transparency about your financial situation. Most landlords are willing to work with tenants who communicate openly and are proactive about finding a solution. By proposing a rent repayment plan, you can demonstrate your commitment to fulfilling your financial obligations and maintaining a good relationship with your landlord.

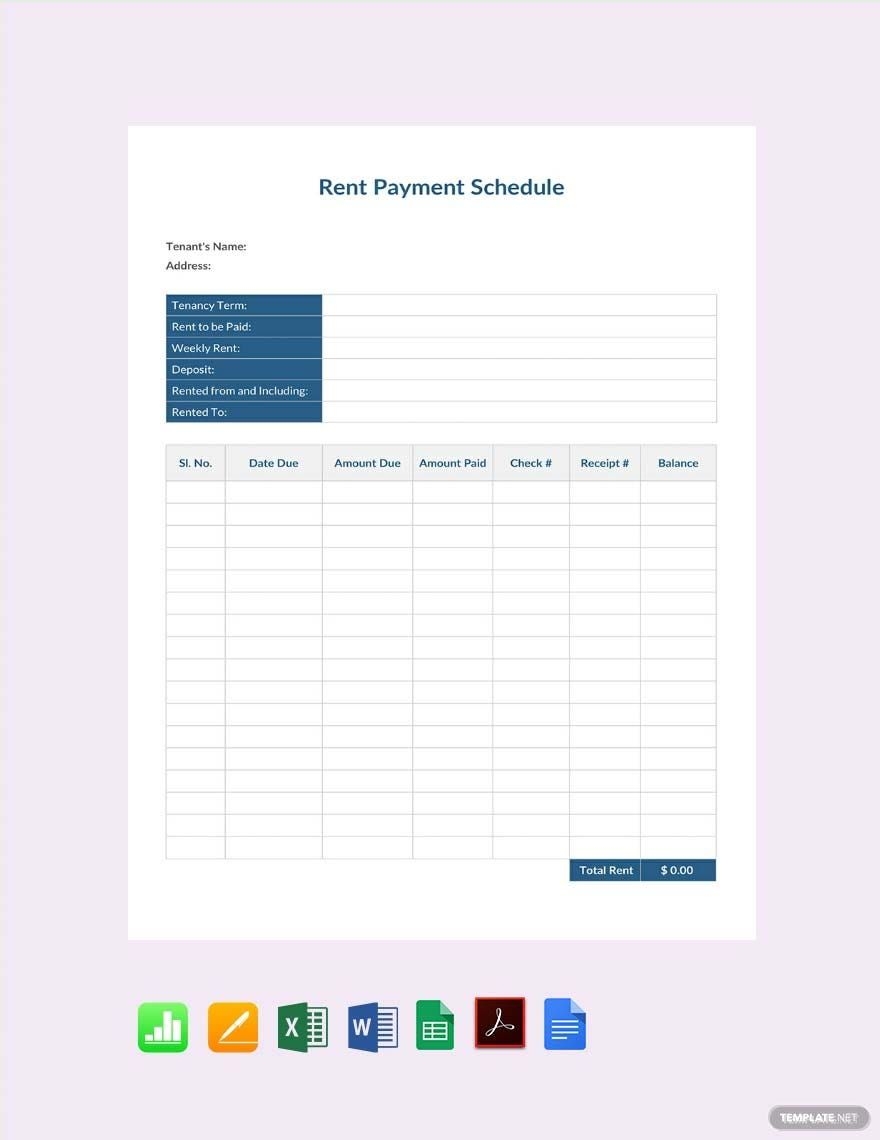

Rent Repayment Plan Template

Below is a sample template for a rent repayment plan that you can use as a starting point when negotiating with your landlord:

1. Statement of Financial Hardship

Begin by outlining the reasons why you are unable to pay rent in full and on time. Provide details about your current financial situation, such as job loss, medical expenses, or other unexpected costs that have impacted your ability to make rent payments.

2. Proposed Repayment Schedule

Specify the amount of rent you can afford to pay each month and the duration of the repayment plan. Be realistic about what you can afford and propose a timeline that works for both you and your landlord. It’s important to demonstrate that you are committed to making regular payments until the full amount is repaid.

3. Agreement Terms

Include any additional terms or conditions that you and your landlord agree upon, such as late fees, penalties for missed payments, or changes to the lease agreement. Make sure to clarify any misunderstandings and ensure that both parties are in agreement before signing the repayment plan.

4. Signatures

Once the terms of the rent repayment plan have been finalized, both you and your landlord should sign the agreement to make it legally binding. This ensures that both parties are committed to upholding their end of the bargain and provides a formal record of the repayment plan.

In conclusion, a rent repayment plan can be a helpful tool for tenants facing financial difficulties. By communicating openly with your landlord and proposing a realistic repayment schedule, you can work together to find a solution that benefits both parties. Remember to approach the situation with honesty and transparency, and be proactive about finding a resolution that works for everyone involved.